All Categories

Featured

Table of Contents

- – High-End Accredited Investor Platforms

- – Reputable Accredited Investor Opportunities

- – World-Class Accredited Investor Passive Incom...

- – Superior Accredited Investor Opportunities

- – Accredited Investor Wealth-building Opportun...

- – Accredited Investor Investment Networks

- – First-Class Accredited Investor Syndication ...

If you're a financial investment professional with a Collection 7, Series 65 or Series 82 or about to come to be one in some situations you're taken into consideration an approved investor. Very same if you're at the supervisor or over level of the firm offering the safety and security, or if you're an experienced staff member of a personal fund that you want to buy.

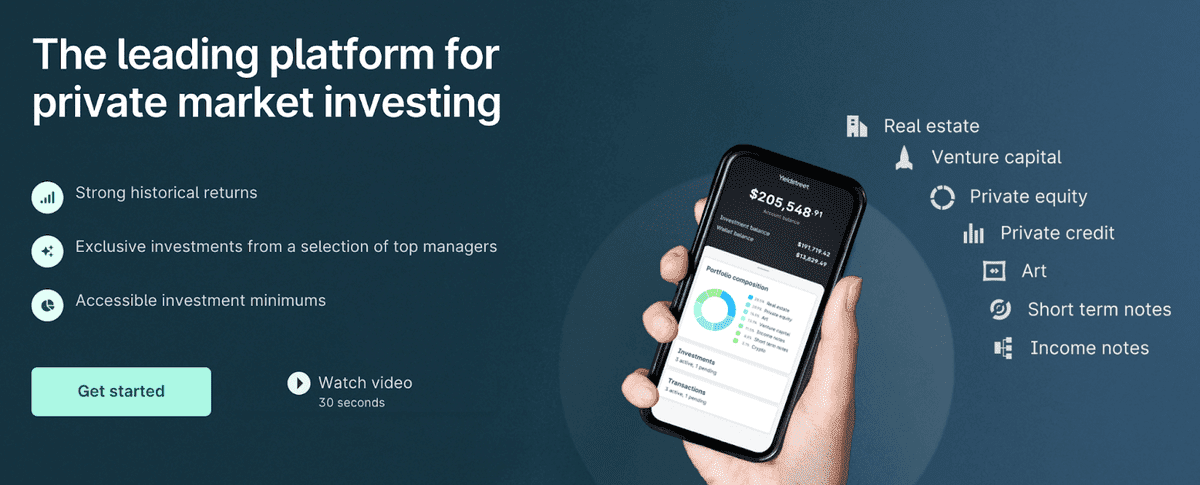

There are a wide range of opportunities for certified capitalists. The on the internet investing system Return Road, for instance, offers art, crypto, property, equity capital, temporary notes, lawful financing funds and other specialized asset courses. Various other platforms, AcreTrader and Percent, as an example, deal access to farmland investments, seller cash money advances and more.

Usually talking, these kinds of opportunities aren't listed they come from who you know and what you're entailed in.

Bear in mind, the intention behind stopping retail investors from buying unregistered safety and securities is to protect those that don't have the economic means to endure big losses.

High-End Accredited Investor Platforms

An individual have to have a total assets over $1 million, excluding the main home (individually or with spouse or companion), to certify as a certified investor - private placements for accredited investors. Demonstrating enough education and learning or job experience, being a signed up broker or financial investment advisor, or having certain expert qualifications can additionally qualify a specific as a recognized financier

Approved investors have accessibility to investments not registered with the SEC and can include a "spousal matching" when figuring out certification. Certified capitalists may deal with potential losses from riskier financial investments and must confirm monetary class to take part in unregulated investments. Approved investor standing issues due to the fact that it figures out eligibility for investment chances not readily available to the public, such as personal positionings, equity capital, hedge funds, and angel financial investments.

To participate, recognized financiers have to come close to the provider of unregistered safeties, who might need them to complete a survey and provide monetary files, such as income tax return, W-2 kinds, and account statements, to confirm their standing. Regulations for recognized investors are looked after by the united state Stocks and Exchange Commission (SEC), ensuring that they fulfill particular financial and specialist criteria.

Reputable Accredited Investor Opportunities

This expansion of the accredited investor swimming pool is planned to keep financier security while providing greater accessibility to unregistered investments for those with the needed economic elegance and threat tolerance.

The modern-day age has opened up the door to a lot of accredited investor opportunities that it can make you lightheaded. It's one point to earn money; it's quite another holding onto it and, certainly, doing what's needed to make it expand. The sector has several verticals covering typical asset courses like equities, bonds, REITs and common funds.

While these approved financier investment opportunities are interesting, it can be tough to know where to get begun. If you want to know the ideal investments for accredited financiers, you're in the best area.

World-Class Accredited Investor Passive Income Programs for Accredited Investor Opportunities

Initially, let's make sure we're on the exact same web page concerning what an accredited investor is. You can certify as an approved investor in either ways: A) You have the ideal licensure a Series 7, Series 65, or Series 82 FINRA certificate. B) You satisfy the financial criteria.

Examine out the Whether you're a certified investor currently or just wish to be notified for when you are, right here are the most effective approved investor investments to think about: Score: 8/10 Minimum to begin: $10,000 Equitybee deals approved capitalists the opportunity to purchase companies prior to they go public. This suggests you do not need to wait for a company to IPO to become a stakeholder.

There are plenty of prominent (but still not public) firms presently available on Equitybee: Epic Gamings, Stripes, and Waymo, to name a couple of. As soon as you have actually chosen a business, you can money a worker's stock alternatives via the system.

The capability to obtain access to pre-IPO business might be worth it for some investors. The "one-stop-shop" aspect alone could make it one of the leading certified financiers' investments, however there's even more to such as about the system.

Superior Accredited Investor Opportunities

(Source: Yieldstreet) Score: 8/10 Minimum to obtain started: No lower than $10,000; most possibilities vary between $15K and $40K Rich financiers regularly turn to farmland to branch out and build their portfolios. Why? Well, consider this: In between 1992-2020, farmland returned 11% yearly, and just knowledgeable 6.9% volatility of return. Plus, it has a reduced relationship to the stock exchange than many alternative possessions.

But you can still take advantage of farmland's land admiration and possible rental income by spending in a platform like AcreTrader. (Resource: AcreTrader) AcreTrader is just readily available to accredited investors. The platform offers fractional farmland investing, so you can invest at a lower price than getting the land outright. Below's what's great regarding the system: AcreTrader does the heavy training for you.

Accredited Investor Wealth-building Opportunities

That implies you can relax very easy with the truth that they've done their due persistance. And also, they do all the admin and external monitoring. In terms of exactly how you make money, AcreTrader disburses yearly revenue to investors. According to their web site, this has actually historically produced 3-5% for lower-risk financial investments. There's a possibility for higher returns over the previous 20 years, UNITED STATE

Accredited Investor Investment Networks

It's not hard to difficult why. Let's start with the money. Since February 2024, CrowdStreet has actually moneyed over 787 offers, a total amount of $4.3 billion invested. They flaunt a 16.7% realized IRR and an ordinary hold period of 3.1 years. (Resource: CrowdStreet) Successive, the projects. Once you've given proof of accreditation and set up your account, you'll access to the Marketplace, which includes both equity and financial obligation investment chances which may be multifamily properties or retail, workplace, or also land possibilities.

On Percent, you can likewise spend in the Percent Mixed Note, or a fund of different credit report offerings. It's an easy method to branch out, but it does have higher minimums than some of the various other possibilities on the platform. By the method, the minimum for the majority of chances on Percent is relatively little for this checklist just $500.

First-Class Accredited Investor Syndication Deals for High Returns

You can both invest in the primary market and trade on the second market with other art investors. If it offers for a revenue, the earnings are dispersed among investors.

Table of Contents

- – High-End Accredited Investor Platforms

- – Reputable Accredited Investor Opportunities

- – World-Class Accredited Investor Passive Incom...

- – Superior Accredited Investor Opportunities

- – Accredited Investor Wealth-building Opportun...

- – Accredited Investor Investment Networks

- – First-Class Accredited Investor Syndication ...

Latest Posts

Tax Lien Investing In Texas

Real Property Tax Forfeiture And Foreclosure

Delinquent Tax Roll

More

Latest Posts

Tax Lien Investing In Texas

Real Property Tax Forfeiture And Foreclosure

Delinquent Tax Roll